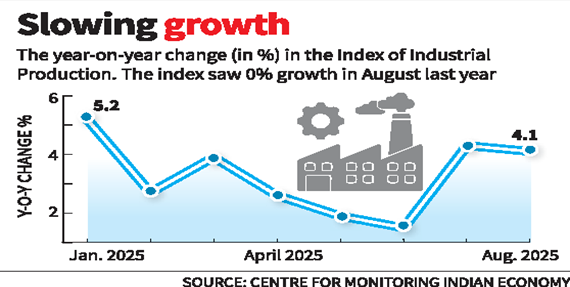

- Industrial output growth slows to 4% in August

Context: Country’s IIP growth gets pulled down by consumer-related sectors; primary goods sector sees a turnaround with seven-month-high of 5.2%; experts say no effect of GST reforms that came in later

- Growth in industrial activity in India slowed to 4% in August from its six-month high growth of 4.3% in July.

- Growth was dragged down by the consumer durables and non-durables sectors, as well as slower growth in manufacturing, capital goods, and infrastructure sectors, government data showed.

- On the other hand, mining activity, the primary goods sector, and electricity output saw a positive turnaround.

- Data on the Index of Industrial Production (IIP), released by the Ministry of Statistics and Programme Implementation, showed that growth in the index this August was considerably faster than the 0% seen in August last year.

- “This data should be read with caution as it captures neither the tariff nor GST effect which have been in the news and affected sentiment in business,” Madan Sabnavis, chief economist at the Bank of Baroda, said. “Tariffs were implemented from August 27 while GST benefits kicked in late September.”

- The mining and quarrying sector in particular saw a significant turnaround. It grew 6% in August, a 14-month high, snapping a four-month streak of contractions.

- The second sector to see a robust turnaround was the primary goods sector, which saw growth coming in at a seven-month high of 5.2%. The electricity sector grew at a five-month high of 4.1%.

- The manufacturing sector, however, slowed to 3.8% in August, down from 6% in July. This was quicker than the 1.2% growth the sector saw in August last year. Similarly, growth in the capital goods sector slowed in August to 4.4% from 6.7% in July. This was, however, quicker than the 0% seen in August last year.

- The growth in the consumer durables sector slowed to 3.5% in August from 7.3% in July and 5.4% in August last year. The consumer non-durables sector saw activity contracting 6.3%, the worst performance in eight months.

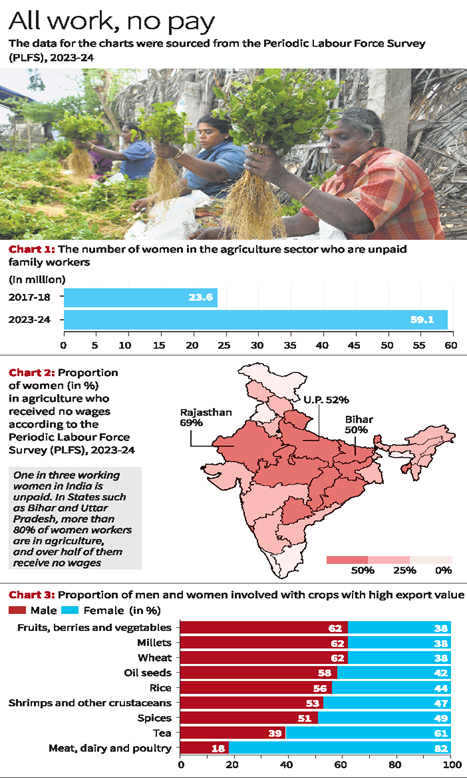

- More women employed in agriculture, but half of them are unpaid

Context: Global trade trends, technology, and land and labour reforms can help bridge the gap

- Women-led development has been recognised as a structural game-changer for advancing India’s economic ambitions, yet its full potential remains under-leveraged. Nowhere is harnessing this potential more urgently than in the agriculture sector, the backbone of India’s economy and the largest employer of its women.

- Despite their growing presence on farms, women’s contributions remain systematically unremunerative. By leveraging recent shifts in trade and technology, India has an unprecedented opportunity to unlock pathways that recognise women as equal partners in agricultural transformation.

- In the past decade, structural shifts in the Indian workforce have drawn rural men into higher-paying non-farm jobs, leaving women to replace them to do the agricultural work. As a result, women’s employment in agriculture surged by 135%, and they now account for over 42% of the sector’s workforce. Two out of every three working women are now in agriculture.

- Yet, this rise has come with diminishing returns. Nearly half of the women in agriculture are unpaid family workers, with their numbers jumping 2.5 times from 23.6 million to 59.1 million in just eight years (Chart 1). As a result, today, one in three working women in India is unpaid. In States such as Bihar and Uttar Pradesh, more than 80% of women workers are in agriculture, and over half of them receive no wages (Map 2).

- Much of this invisibility stems from systemic inequities. Women are not officially recognised as farmers, own only 13-14% of land holdings, and earn 20-30% less than men for equivalent work. Asset ownership, decision-making power, and access to credit and government support remain male-dominated, trapping women in low-value activities.

- As a result, women’s greater participation has not translated into higher income for the economy, as agriculture’s share of the national GVA fell from 15.3% in 2017-18 to 14.4% in 2024-25. Therefore, the ‘feminisation of agriculture; has, in a way, reinforced inequities rather than enabling women’s economic empowerment.

- Global trade trends are opening new windows for women’s economic inclusion in agriculture. The India-U.K. Free Trade Agreement (FTA), for example, is projected to boost Indian agricultural exports by 20% within three years, granting duty-free access to over 95% of agricultural and processed food products. From rice, spices, and dairy to ready-to-eat meals, Indian producers will benefit from premium market access, with safeguards in place for sensitive sectors. Many of these export-oriented value chains employ a significant share of women (Chart 3). If FTA-embedded provisions for women, such as training, credit access, and market linkages, are catalysed, it could enable women’s transition from farm labourers to income-generating entrepreneurs.

- The greatest opportunity lies in enabling women to move from unpaid, low-value tasks into higher-margin segments such as processing, packaging, branding, and exporting. With global demand rising for organic products and superfoods, India’s value chains for tea, spices, millets and certified organic produce are poised for expansion — sectors where women are already strongly represented. Geographical Indications, branding initiatives, and support for meeting export standards can help women producers shift from subsistence farming toward premium, value-added product markets.

- Without targeted measures, women risk being excluded from the export-led opportunities emerging in Indian agriculture. Digital innovations can play a decisive role in bridging this gap. Platforms such as e-NAM, mobile-based advisory services, voice-assisted applications, and precision agriculture tools are already connecting women to markets, knowledge systems, and financial services. These solutions help formalise women’s labour while expanding access to schemes, credit, and fair pricing.

- However, these benefits are contingent on overcoming structural barriers such as low digital literacy, language gaps, and limited access to affordable devices. Tackling these challenges requires collective action by all ecosystem actors — government, private sector, NGOs, self-help groups, and Farmer Producer Organisations (FPOs).

- Encouragingly, promising models are emerging. AI-enabled solutions such as the government’s BHASHINI platform and Microsoft–AI4Bharat’s Jugalbandi are extending multilingual, voice-first access to government services. L&T Finance’s Digital Sakhi programme has trained rural women in digital and financial literacy across seven States.

- At the State level, Odisha’s Swayam Sampurna FPOs showcase how technology can position women farmers at the forefront of export competitiveness. The Jhalawari Mahila Kisan Producer Company in Rajasthan leverages digital tools for direct sales and branding. Multi-stakeholder training programs for women farmers in Assam’s tea sector focus on diverse areas. It is important to scale up and emulate these platforms.

- To transform women’s role in agriculture, land and labour reforms are equally vital. Policies must recognise women as independent farmers by promoting joint or individual land ownership, which in turn strengthens their eligibility for credit, insurance, and institutional support.

- X to appeal HC judgment upholding Sahyog portal

Context: X, formerly Twitter, said that it would appeal the Karnataka High Court’s decision that rejected its challenge to the Union government’s Sahyog portal.

- The Sahyog portal was set up last year to allow the police and other authorised government agencies to send takedown notices to social media platforms, a move that X has argued is a broad and illegal censorship regime that would leave it with criminal liability if it did not comply.

- The company said it was “deeply concerned” by the judgment handed down by the single Bench of judge M. Nagaprasanna, and that it would appeal. It did not indicate whether this appeal would be directed to a larger bench of the Karnataka High Court, or to the Supreme Court.

- “The Sahyog [portal] enables officers to order content removal based solely on allegations of ‘illegality,’ without judicial review or due process for the speakers, and threatens platforms with criminal liability for non-compliance,” the platform said.

- “X respects and complies with Indian law, but this order… is inconsistent with the Bombay High Court’s recent ruling that a similar regime was unconstitutional.”

- X is referring to the Centre’s fact checking unit, which was designed to flag misinformation about the Centre that, once a given post was notified, would strip away the “safe harbour” that a platform would enjoy for continuing to host it; the “intermediary,” X, in this case, would be liable for posts made by users as though it were a publisher. The Sahyog portal, X argues, is similar.

- Justice Nagaprasanna argued in his ruling that X was not in a position to take umbrage under constitutional guarantees as its parent, X Corp., is a foreign company.

- Two railway links to offer easy connectivity to Bhutan

Context: Kokrajhar-Gelephu and Banarhat-Samtse lines will run to a total distance of 89 km; they will be developed at a cost of ₹4,033 crore; Railway Minister says project will boost economy, tourism.

- The Centre announced two rail links with a total distance of 89 km between India and Bhutan — Kokrajhar-Gelephu (Assam) and Banarhat-Samtse (West Bengal) — at a cost of ₹4,033 crore.

- These two projects are part of the first set of rail connectivity projects between India and Bhutan, Foreign Secretary Vikram Misri announced at a press conference.

- The memorandum of understanding (MoU) for these projects was signed during Prime Minister Narendra Modi’s visit to Bhutan in March 2024 and a formal agreement was signed here on the occasion of the Bhutanese Foreign Secretary’s visit to New Delhi.

- “India is the largest trading partner of Bhutan. Most of the EXIM trade of Bhutan is through Indian ports, therefore, it becomes very important to have seamless rail connectivity for the Bhutanese economy to grow, and for the Bhutanese people to have better access to the global network,” Railway Minister Ashwini Vaishnaw said.

For Vande Bharat trains

- The Minister said the two rail links would provide Bhutan access to 1,50,000 km of the Indian railway network. While the Kokrajhar-Gelephu rail link would be developed over the next four years, the Banarhat-Samtse line would be constructed over a period of three years. The railway lines would be designed for running Vande Bharat trains. The former will have six stations, two viaducts, 29 major bridges, 65 minor bridges, two good sheds, one flyover and 39 underpasses. The latter will include two stations, one major flyover, 24 minor flyovers, and 37 under passes. It will be developed at a cost of ₹577 crore.

- “This will provide a lot of economic benefits to the people, in terms of tourism, industrial growth, people-to-people movement, and goods movement. Practically, every benefit that railway brings will happen with this,” Mr. Vaishnaw added.

- The Government of India has pledged ₹10,000 crore in development assistance to Bhutan for its 13th Five-Year Plan running from 2024 to 2029. This funding doubles the support provided during the 12th Plan.

- Bhutan is also set to benefit from the Jogighopha Inland Waterways Transport Terminal, opened in February. The two nations have also collaborated on five major hydropower projects — Chukha, Tala, Mangdechhu, Kurichhu, and the recently completed Punatsangchhu II.

- Govt. norms for EV charging infra subsidy

Context: The Centre has issued norms offering up to 100% subsidies for setting up vehicle charging stations, battery swapping and charging stations, targeting high-density cities, satellite towns, and key national and state highways.

- The guidelines were issued under the ₹10,000- crore PM E-drive scheme for promotion of EVs within which ₹2,000 crores has been apportioned for charging infrastructure.

- The government is aiming at installing 72,300 EV chargers for cars, two- wheelers, buses and trucks, said Additional Secretary, Ministry of Heavy Industries, Dr. Hanif Qureshi in a LinkedIn post.

- The post mentioned the government was aiming at a charging grid coverage of at least one charging station in every 3km × 3km grid; on highways, one every 25 km, plus long-range EV chargers every 100 km.

- The ₹2000 crore subsidy offers support for chargers in government buildings like offices and hospitals, private establishments, including malls and metro stations and other locations as determined by State/ UT governments.

- “India is ensuring infrastructure leads the way — breaking the adoption bottleneck, boosting consumer confidence, and building a strong public-private ecosystem for clean mobility,” Dr. Qureshi added.

- State launches Unified Land Acquisition System to ensure transparency and efficiency

Context: The Karnataka government on Monday launched the Unified Land Acquisition System (ULMS) Data Module, aimed at streamlining and digitising the land acquisition process across the State. Officials said the platform will bring greater transparency, efficiency, and accountability in land acquisition proposals and ongoing litigations.

- Developed by the Centre for Smart Governance under the e-Governance Department, the module has been created with inputs from an expert committee of the Revenue Department, senior officers, Special Land Acquisition Officers (SLAOs), and field officials.

Common platform

- The system will serve as a common platform for multiple land-acquiring agencies, including Revenue, Irrigation, Urban Development, BDA, BMRDA, Metro, K-Ride, KSHIP, KIADB, KHB, and NHAI. It will provide a consolidated dashboard offering real-time updates on the status of land acquisition proposals.

- Officials said the module will cover the full life cycle of acquisition — from proposal submission to award, compensation, and rehabilitation — in line with the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013.

- Integration with systems such as Bhoomi, e-Swathu, e-Aasthi, Kaveri 2.0, and Khajane II will ensure that authentic data is sourced directly from respective departments.

- Revenue Minister Krishna Byre Gowda, who launched the module, said, “With ULMS, Karnataka is setting a new benchmark in citizen-centric governance. The platform ensures transparency for landowners and affected families while providing officials with a robust workflow. It balances the State’s development needs with the rights of citizens.”

- HC: Charge created earlier will prevail during conflict between GST Act and SARFAESI Act

Context: If there is a conflict between the GST Act and the SARFAESI Act, the priority of the charge must be determined based on the order in which the charges were created, said the Karnataka High Court.

- “If the charge under the Goods and Services Tax (Tax) Act was created prior to that under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002, the GST Act will prevail, and vice versa,” the court said while clarifying the position of law when charges were created separately on a same property under these two enactments.

- Justice Suraj Govindaraj passed the order while allowing a petition filed by Canara Bank while challenging the charge/encumbrance created by the State Commercial Tax Department over an immovable property, which was already mortgaged to the bank, for GST dues. The court declined to accept the Commercial Tax Department’s argument that only the claims under the Insolvency and Bankruptcy Code (IBC) can override those under the GST Act, and that, since the GST Act is subsequent to the SARFAESI Act, the GST Act should prevail in all circumstances of charges.

- The claim under the GST Act, the court said, is not directly enforceable until the tax authorities have made an assessment and an entry is made on public records, like the encumbrance certificate or property card. What needs to be considered is the date of creation of the charge, the court pointed out.

- If the charge under the SARFAESI Act was created before the charge under the GST Act, the SARFAESI Act charge would take precedence, the court said while pointing that the charge in the present was created in 2017 by the Bank and the charge over the same immovable property was created by the department only in 2019

- While directing the department to remove the encumbrance or charge created over the property in question, the court permitted the bank to auction the property to recover dues to it and if any surplus amount remains after dues to the bank, the same should be deposited with the department for adjustment towards GST dues.