EC claims ‘exclusive’ power to decide how and when to hold SIR

The Election Commission (EC) has, in no uncertain terms, told the Supreme Court to leave alone its “exclusive jurisdiction” to decide when and how to conduct Special Intensive Revision (SIR) of electoral rolls.

The EC was responding to a petition seeking a judicial direction from the top court to the panel to conduct SIR at “regular intervals” across the country to identify and expel foreign infiltrators enrolled as voters. The EC said its power to decide if a revision exercise would be intensive or summary would “depend on the situation”. The call was entirely its own and outside the judicial ambit.

“The decision to conduct a summary or an intensive revision of the electoral roll is left to the discretion of the EC. The EC has complete discretion over the policy of revision to the exclusion of any other authority,” it submitted.

Provisions of the Representation of the People Act, 1950 and the Registration of Electoral Rules, 1960 gave the EC “complete discretion on the timing of the revisional exercise”. “The obligation to conduct a revision is not couched within a timeline,” the EC noted. It said the law allowed it power to hold a special revision of the rolls of any constituency or part of it “in such a manner as it may think fit”.

The petitioner, Ashwini Kumar Upadhyay, said periodic SIR before every general, State and local body elections was necessary to protect the purity of the electoral process. But the panel would brook no interference from the courts.

“A direction to conduct SIR at ‘regular intervals’ throughout the country would encroach the exclusive jurisdiction of the Election Commission,” the poll body said.

The exchange has come in the middle of an ongoing dispute over the Bihar SIR exercise, which petitioners, including Opposition political parties, have claimed to be “citizenship screening” in the guise of a revisional exercise of the State’s electoral roll.

The poll body assured that it was “fully cognisant of its statutory duty to maintain the purity and integrity of the electoral rolls”.

The EC confirmed there would be a nationwide SIR with January 1, 2026 as the qualifying date.

“There is a letter of July 5 to all Chief Electoral Officers (CEOs) of States and UTs to initiate immediate pre-revision activities for the SIR of electoral rolls with reference to January 1, 2026 as the qualifying date on a nationwide basis,” the EC informed the court.

The poll body said it had convened a conference of all the CEOs of the States and Union Territories in New Delhi on September 10 to “further strengthen and coordinate preparatory measures for conducting SIR” nationwide.

‘Impose tariffs on Russian oil buyers’

The U.S. has asked G7 countries to impose tariffs on countries purchasing oil from Russia, asserting that only “unified efforts” that cut off funding to Moscow’s war machine at source can apply sufficient pressure to end “the senseless killing” in Ukraine.

U.S. Treasury Secretary Scott Bessent and Trade Representative Ambassador Jamieson Greer were on a call with G7 Finance Ministers when they reiterated Donald Trump’s call for imposing tariffs.

The U.S. has asked G7 members to impose tariffs on countries purchasing oil from Russia, asserting that only “unified efforts” that cut off funding to Moscow’s war machine at source can apply sufficient pressure to end “the senseless killing”.

Treasury Secretary Scott Bessent and the U.S. Trade Representative, Jamieson Greer, were on a call with G7 Finance Ministers on Friday when they reiterated President Donald Trump’s call to the bloc’s partners about imposing tariffs on countries purchasing oil from Russia.

G7 is an intergovernmental bloc of rich, industrialised countries comprising the U.S., Canada, France, Germany, Italy, Japan, and the U.K.

Meanwhile, Mr. Trump said he was ready to sanction Moscow, but on the condition that all NATO allies agree to completely halt purchases of Russian oil and implement their own sanctions.

He also suggested members of the transatlantic alliance consider slapping tariffs of 50% to 100% on China as a way to help end Russia’s war in Ukraine. “I am ready to do major Sanctions on Russia when all NATO Nations have agreed, and started, to do the same thing, and when all NATO Nations STOP BUYING OIL FROM RUSSIA,” Mr. Trump said in a social media post, which he described as a letter to all NATO nations and the world.

The U.S. has imposed 50% tariffs on Indian goods, including a 25% additional duty for India’s purchase of Russian crude oil.

Mr. Trump branded NATO nations’ purchase of Russian oil “shocking” and said it weakens their bargaining power over Moscow. “Anyway, I am ready to ‘go’ when you are. Just say when?”

“I believe that (NATO sanctions on Russia), plus NATO, as a group, placing 50% to 100% TARIFFS ON CHINA, to be fully withdrawn after the WAR with Russia and Ukraine is ended, will also be of great help in ENDING this deadly, but RIDICULOUS, WAR,” Mr. Trump added.

Confusion over clearances for Great Nicobar project persists

Months before seeking a report from the Andaman and Nicobar Islands administration on alleged violations of forest rights while executing the ₹81,000-crore Great Nicobar Islands development and infrastructure project, the Tribal Affairs Ministry had told a Bench of the Calcutta High Court that it should be dropped as a party in a petition that challenged the project’s clearances on the same grounds.

The court is hearing a batch of petitions challenging the forest clearance. The petitions, filed by the former official Meena Gupta, argue that provisions of the Forest Rights Act, 2006 were violated in obtaining the consent of the tribespeople to divert about 13,000 hectares of forestland for the project, which includes a transshipment port, an airport, a power plant, and a township.

Earlier this week, the Ministry sought a “factual report” from the islands administration on a fresh complaint from the Tribal Council of Little and Great Nicobar that processes under the Act had not even been initiated in Nicobar, contrary to what the Deputy Commissioner of Nicobar certified in August 2022, claiming that all rights under the legislation had been identified and settled and consent obtained for diversion.

The Union Environment and Tribal Affairs Ministries and the islands administration had filed pleadings before the court between January and February. In these affidavits, the Environment Ministry said it was yet to receive a compliance report from the islands administration on the completion of all 37 conditions imposed in its Stage I clearance for the project, of which one is the FRA compliance.

In defending itself and insisting that all procedures under the FRA were followed, the islands administration has accused the petitioner of “cloaking” a “private interest litigation” petition as a public interest litigation petition.

FRA is State domain

However, the Tribal Affairs Ministry, the nodal Ministry for the FRA, has submitted that it should be “removed from the list of respondents”, arguing that the implementation of the law falls upon the respective State or Union Territory. In its February 19 affidavit, the Ministry denied and disputed all assertions made in the petition.

Notably, with regard to the no-objection certificate issued by it in 2020 for the project, mandating FRA compliance, the Ministry said the NOC was “given on the basis of facts given by the Andaman and Nicobar Administration in the denotification proposal”.

This comes even as Tribal Affairs Minister Jual Oram told The Hindu in 2024 that his Ministry would look into the clearances obtained for the project. Earlier this year, Mr. Oram had said at a public event that the Ministry was looking into the concerns raised about the project.

Land a State subject

In its complaint, the Tribal Council for Little and Great Nicobar alleged that this certificate amounted to a “false” representation as the process for recognising and vesting rights under the FRA had not even been initiated on the Nicobar islands.

However, in submissions to the High Court, the Environment Ministry has not mentioned this certificate.

It has said that land is a State subject, further asserting that the Ministry of Tribal Affairs is the nodal Ministry for the Forest Rights Act, 2006. In its affidavit, dated January 14, it went on to submit that no provisions of the Van (Sanrakshan Evam Samvardhan) Rules, 2023, “abrogate” any part of the FRA.

SC restores Rajasthan royal estates to Khetri Trust

The Supreme Court has restored the ₹3,000-crore historic estates of a Constituent Assembly member and former parliamentarian, Raja Bahadur Sardar Singh, to a trust he created for charitable purposes after a nearly four-decade-old litigation with the State of Rajasthan over his will.

The court’s recent order, published on Saturday, would act as a precedent against the government interfering in or caveating private wills without first proving intestacy (absence of a will) and a complete absence of heirs. A Bench of Justices B.V. Nagarathna and Satish Chandra Sharma realised Singh’s instruction in his 1985 will to bequeath his assets to the Khetri Trust, an organisation founded by the former Rajasthan royal, who played a part in the framing of the Constitution, to promote education and advance the study of science, literature and the arts in India.

The Khetri Trust website shows the chairman as Maharaja Gaj Singh, a former Rajya Sabha member and former Indian High Commissioner. The trustees include Prithvi Raj Singh; Lord Northbrook (Francis Thomas Baring), a British Conservative politician; Ajit Singh, Additional Director-General of Police of Rajasthan; and Kanupriya Harish, a development specialist. The estates include landed properties and palaces in Jaipur, Khetri, Chiwara, Singhana, Kotputli, and Mount Abu in Rajasthan.

The estates had been locked in a dispute with the State of Rajasthan, which had claimed them on the principle of escheat (heirless property devolving to the state). The State had contested the will, claiming Mr. Singh had died ‘intestate’ or without a will.

The State had refused to give up the litigation even after a Division Bench of the Delhi High Court probated or validated the authenticity of Singh’s will. Upholding the High Court decision, the top court Bench observed the State government was a “stranger” which had no locus standi (the right to bring a dispute to court) whatsoever to challenge the former royal’s will.

“Only when there is failure of heirs that the estate of an intestate Hindu would devolve on the Government under Section 29 (principle of escheat) of the Hindu Succession Act. This means that till that stage arrives, the government is a stranger to the probate proceedings and any proceeding regarding succession under the personal law,” the Bench said.

The court further noted that a grant of probate by a competent court of law could be challenged only by likely heirs of the testator either through an appeal or by seeking revocation of the probate. The State cannot presume locus standi by merely invoking the Rajasthan Escheat Regulation Act of 1956, the court said.

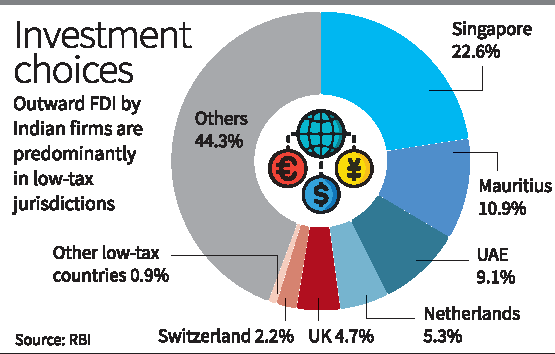

About 60% of India’s outward FDI goes to ‘tax havens’

An analysis of RBI data by The Hindu shows that nearly 56% of such investments in 2024-25 were

in low tax jurisdictions such as Singapore, Mauritius, UAE, the Netherlands, U.K. and Switzerland

Indian companies are increasingly leveraging low-tax jurisdictions abroad to channel their foreign investments in a bid to increase their global presence, according to data as well as tax and investment experts.

An analysis by The Hindu of data from the Reserve Bank of India (RBI), which closely tracks outward investments by Indian companies, shows that nearly 56% of such investments in 2024-25 were in low tax jurisdictions (commonly called tax havens) such as Singapore, Mauritius, the United Arab Emirates, the Netherlands, the United Kingdom, and Switzerland.

In other words, out of the total ₹3,488.5 crore of outward foreign direct investment (FDI) by India in 2024-25, about ₹1,946 crore went to these low tax jurisdictions.

In fact, just three of these countries — Singapore (22.6%), Mauritius (10.9%), and the UAE (9.1%) — accounted for more than 40% of India’s outward FDI in 2024-25.

Further, this trend seems to have increased in intensity in the current financial year. In the first quarter, these low tax jurisdictions accounted for 63% of India’s total outward FDI. However, while countries around the world, including India, have sought to crack down on the trend of companies shifting profits to these tax havens, experts have said that choosing these low tax jurisdictions is also a strategic imperative for Indian companies, and not just a tax issue.

“If Indian companies are making investments outside India, then having them through a company set up in one of these jurisdictions makes a lot of sense,” according to Riaz Thingna, Partner, Grant Thornton Bharat.

He said that, if an Indian company is looking to set up a subsidiary in Europe, the US, or any other country, then doing it through a special purpose vehicle in Singapore or a similar jurisdiction will help them in getting strategic investors, and in providing better tax positioning at the time of stake dilution.

“These jurisdictions are also more flexible in transferring funds and investments on a day-to-day basis,” Mr. Thingna explained. So, very often, these investments are not being made only to evade, avoid or reduce tax. They are often made because these jurisdictions form platforms for investment in third countries.”

First level

Vaibhav Luthra, Tax Partner at EY India, too, explained that the RBI data does not provide the ultimate investment destination, but only shows the first level of outward investments.

According to Luthra, these low-tax or “tax efficient” jurisdictions not only provide a tax advantage, but also offer tax stability. Apart from this, they also come with other advantages for Indian companies looking to invest abroad.

“A lot of the time, for things like fund raising, or for an investor coming in, they usually like coming in at these intermediate jurisdictions,” he explained. Also, having an entity in the middle also protects the Indian parent company.”

Mr. Thingna also pointed to the propensity of foreign companies to choose a low-tax jurisdiction to form a joint venture rather than in India.

“If the Indian company is looking for a strategic partner, a strategic partner from any other country will be happier investing into the Singapore entity, or one in a similar jurisdiction, than into the Indian entity because of our FDI regulations, our taxation and various other elements,” Mr. Thingna explained.

The RBI data also points to this trend.

The data for July 2025, the latest available data on outward investment, shows that joint ventures accounted for almost 60% of the investments made by Indian companies in the low-tax jurisdictions.

Tariff outcome

Mr. Thingna was also of the belief that the high tariffs imposed by the U.S. on imports from India could induce Indian companies to invest abroad, if they continue.

“There could be a lot of companies who will set up subsidiaries and other entities outside India, where the value addition is done, and accordingly escape the harsher tariffs on India,” Mr. Thingna said.

“This has not happened yet, as the tariffs are recent, but it could happen.”

Corteva launches

pesticides for use

on potato, grapes

The Hindu Bureau

New Delhi

Global pesticides company Corteva Agriscience has launched two pesticides against diseases like ‘Downy Mildew’ in grapes and ‘Late Blight’ in potatoes.

The company claimed that both the chemicals will transform potato, grapes cultivation in India.

A release from Corteva said building on the globally successful Zorvec technology, this advanced solution offers growers protection against the devastating diseases and will lead to healthier crops, higher yields and superior quality produce.

“Zorvec Entecta delivers a unique combination of advanced chemistry and powerful performance. Its active ingredients provide strong and reliable control against oomycetes plant diseases,” it said.

The release added that the chemical is secure and protected from wash-off just 20 minutes after application.

What are Foreigners Tribunals’ new powers?

The Union Ministry of Home Affairs (MHA) recently notified Rules, Order and Exemption Order, which made the Immigration and Foreigners Act, 2025 operational. Parliament passed the legislation to regulate all matters relating to foreigners and immigration in April. It repealed and replaced several Acts, the Passport (Entry into India) Act, 1920; the Registration of Foreigners Act, 1939; the Foreigners Act, 1946 and the Immigration (Carriers’ Liability) Act, 2000.

What was the rationale?

The Government said a new legislation was required to avoid multiplicity and overlapping of laws on passports or other travel documents in respect of persons entering and exiting from India, and to regulate matters related to foreigners’ visa, registration and immigration issues. Though most provisions in the newly notified Rules, Order and Exemption Order were there in past notifications, certain new clauses and conditions have been added, considering the vast changes that have occurred after the original pre-Independence Acts came into existence.

What does the Immigration and Foreigners Rules say?

For the first time, the Rules legally designate the Bureau of Immigration (BOI) to “examine cases of immigration fraud” and co-ordinate with the States to identify, deport or restrict the movement of foreigners and collate and maintain an immigration database among others. Though the BOI earlier also performed similar functions, its role was regulatory and not mentioned in the law. In another first, the Rules insert legal provision for recording of biometric information of all foreigners, earlier restricted to a few visa categories and enforceable through executive orders of the MHA.

Educational institutes will have to inform the Foreigners Regional Registration Office (FRRO) about all foreign students and even provide semester-wise “academic performance” summary such as attendance details and “general conduct” report. While earlier, the “civil authority” could direct to shut down any premise such as a resort, club or an entertainment place if it was frequented by foreigners who are “undesirable”, involved in crime or members of an unlawful group, the new Rules add “illegal migrant” to the list too.

The Rules define the role of an “immigration officer”, who will be officers provided by the Intelligence Bureau.

What does the Immigration and Foreigners Order, 2025 entail?

Foreigners Tribunals (FT), so far unique to Assam, have been given the powers of a first class judicial magistrate. It paves the way to send a person to a detention or a holding centre if he or she fails to produce any proof that they are “not a foreigner”. The 2025 Order that replaces the Foreigners (Tribunal) Order, 1964 empowers FTs to issue arrest warrants if an individual whose nationality has been contested fails to appear in person.

According to Assam’s Home Department, there were 11 Illegal Migrant Determination Tribunals (IMDT) in the State which were converted to tribunals after the Supreme Court scrapped the Illegal Migrants (Determination by Tribunals) Act, 1983 in 2005. A total of 100 FTs is currently operational in Assam. The number of FTs were enhanced after the National Register of Citizens (NRC) was published in 2019 in Assam on the orders of the top court. The NRC, again unique to Assam, excluded 19 lakh out of 3.29 crore applicants and FTs were to give adequate opportunity to those excluded to present their case. The State government has challenged the NRC in its current form and the final register is yet to be printed. Those excluded are yet to be provided with rejection slips.

Earlier, the FTs could have unspecified number of members, now the number of members has been capped at three, and the ex-parte orders can be set aside if the appellant files the review within 30 days. FTs are functional only in Assam. In other States, an illegal migrant is produced before a local court.

The order also legally allows border guarding forces or the coast guard to prevent illegal migrants attempting to enter into India by sending them back after capturing their biometric information and available demographic details on the designated portal of the Central Government. The Border Security Force (BSF) and the Assam Rifles (AR) posted along the Bangladesh and Myanmar borders had been practising this through executive orders of the MHA — now, it has been stipulated under law.

What is the Immigration and Foreigners (Exemption) Order, 2025?

The Order exempts Nepalese, Bhutanese and Tibetans from the provisions of the Act. It has, however, added two other categories. Registered Sri Lankan Tamil nationals who have taken shelter in India up to January 9, 2015 have been exempted from the provisions of sub-sections (1), (2) and (3) of Section 3 (requirement of passport or other travel document or visa) of the 2025 Act. The notification also exempts undocumented members of six minority communities from Afghanistan, Bangladesh, and Pakistan from penal provisions and deportation if they entered India without passports or visas, or with expired travel documents, before December 31, 2024. MHA officials clarified that while minorities from the three countries could apply for long-term visas (LTVs), a precursor to citizenship, this is not applicable for Sri Lankan Tamils.